To reach our main goal of transforming the complicated online financial world into something far better for users I challenged ourselves to build the simplest, most delightful and enjoyable digital banking design ever experienced. I strove to prove that it's achievable without losing any of the wide variety of banking functions.

I invite you to explore my journey to a new strategy of designing financial products that is unlike anything you have ever seen before. This mobile banking UX design concept, does not try to be the ’perfect’ banking solution. Instead, its goal is to present a completely different approach to financial services design. It's about creating a click-less banking interface by using gesture interactions.

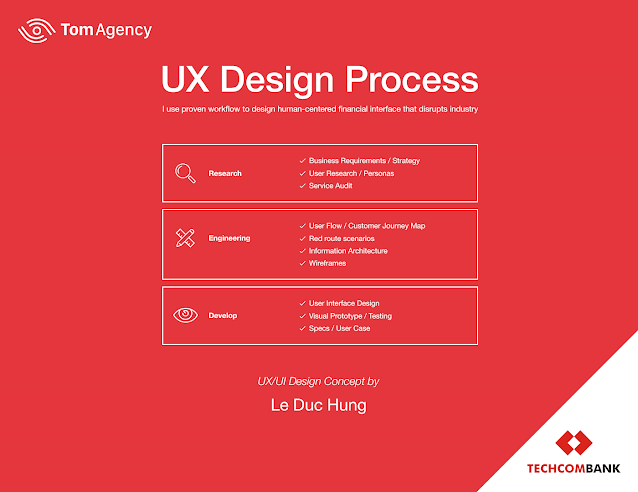

1. Careful

assistant research

Create a use case matrix

that will help you identify why users are interacting with the device. What is

their primary mode of interaction? What is secondary? What is a nice-to-have

interaction mode and what is essential?

You can create a use case

matrix for each mode of interaction. When applied to voice interaction, the

matrix will help you understand how your users currently use or want to use

voice to interact with the product — including where they would use the voice

assistant:

Now that we’ve explored our

constraints, dependencies, and use cases, we can start to dive a little deeper

into the actual voice UX. First, we’ll explore how devices know when to listen

to us.

For some added context, this

diagram below illustrates a basic voice UX flow:

DISCLOSURE: This post may contain affiliate links, meaning when you click the links and make a purchase, we receive a commission.

2. Finding

personas for my story

By conducting multiple

interviews, collecting openly accessible data, and setting up different surveys

on social media we created the key user personas as possible customers of the

Techcombank app. Based on the results of

our research, the personas were a student, a office and an entrepreneur.

The main characters were

generally described as :

1. Discoverers - energetic

people who keep up with the current trends and consider traditional banking

apps to be complicated and tedious.

2. Lovers of beauty -

enthusiasts of good-looking, authentic solutions and modern novelties, eager to

maintain their appreciation of beauty in their lives.

After discovering these

values in our customers, we realized that our mobile banking design had to be:

1. mind-blowing,

2. emotionally engaging,

3. delightful,

4. easy to use,

5. innovative.

In other words, our end

product needed to be cutting-edge, visually appealing, and emerge as one of the

top banking apps in the market.

3. Open

your heart to your users’ feelings

Next, for each of the

personas, we built an Empathy Map. It compiled what would become the main paths

of usage, based on their importance. By doing this we were able to have a

better understanding of our heroes’ emotional aspects.

When creating the Empathy

Map, I discovered a lot of pain points and dissatisfaction in regards to my

personas experiences when they used other common banking services. The main

issues included difficulty understanding the out-of-date designs of the

service. To improve this, we had to gain a better understanding of our

customers, their expectations and needs.

My characters were eager to

use non-banking types of solutions. They were also advised to try alternative

options by their friends, who were already using these kind of products.

4. Create a

map of mobile bank journey

During this phase, we merged

the observations collected in the earlier stages into a document called

Customer Journey Map (CJM). It's based on Business, User, Product and is

specifically tailored for the development of financial solutions.

Our goal was to learn about

the essence of what exactly the users were expecting from the banking app, what

kind of feelings they would experience when they used it, and their main usage

paths, along with business objectives, KPI's and an action plan. Being able to

see the whole picture helped us to create a detailed step-by-step product

experience that would satisfy the needs of both the users and the business in

the best possible way.

During this stage, we

determined exactly what the most crucial action points would be from the users’

emotional point of view.

The banking's Customer

Journey Map consisted of 5 stages, 17 touchpoints and 346 bullets. For more

complicated banking platforms there can be more than 100 touchpoints and up to

2,000 bullets. Take a look at this explanation of a Customer Journey Map to

gain a better understanding of how this works.

Let's say that the aim of a

touchpoint ’Top up account’ is to quickly and securely increase the amount of

money held in a user’s Techcombank account by transferring funds from another

bank account. In this case, the main tasks consist of:

Transfer in Techcombank

Instant transfer 24/7

Payment services

By doing these tasks, a

person can sense different feelings such as impatience and excitement. Also, at

this step, the user might have some questions, such as:

How can I quickly access my Techcombank

account?

What information is required from me?

Is this secure?

How long will this process take?

If we talk about the

possible pain points a user could have, one of them would definitely be their

obligation to enter the payment data repeatedly, every time, when performing a

top-up function to add money to their Techcombank account.

From the perspective of a

business, the most important goals of this touchpoint could be the frequency of

top-ups and amount of money being topped up by the users.

Furthermore, the KPI's (Key

Performance Indicators) could be determined by:

the percentage of transactions with or

without errors;

the average amount of time spent to

complete a transaction;

the average amount of transactions.

Also, it is crucial that the

users consider the process of adding money to the account to be simple, easy to

understand and as safe as possible. At this particular stage, the banking app

can state the benefit to the users as ‘top-up your account in seconds’.

After learning about the

customers and the businesses, we were able to determine what was necessary at

each step of the user’s interaction with the app. This allowed us to prepare a

list of functional requirements for the project, create a Red Route Map

Analysis, and identify ‘power’ user scenarios.

5. Create

Information Architecture for mobile banking app UX design

Next, we were able to

prepare the structure of the banking app’s design based on the mental models of

user perception, so that they can easily understand the structure and principle

of operations in our product. After creating the architecture of the

information we were able to learn everything about the conceptual service

model, which was created from fundamental sections of data along with a

thesaurus. To achieve this, it was beneficial to use a practice called ‘Card

Sorting’, in which potential users are asked to arrange components of a product

according to the specifics of their mental model.

What will the workflow of a

voice assistant in the challenger bank design look like? Suppose you want a

personal loan; tap a mic icon and voice your request. Banking careful assistant

identifies your request and offers a choice of available options. In this

particular digital banking case study, one of the offers has already been

prepared and approved according to your credit score. All that remains is to tap

“Confirm,” and the money will appear on your balance in seconds.

This is one of the basic

principles of the future bank user experience — proactivity instead of

reactivity. Future banks won’t have to wait for a request from a user.

Financial careful assistant will automatically prepare and approve a proposal

for the maximum number of services using big data-based predictive analytics.

This will significantly enhance the banking customer experience and provide

instant service.

6.

Transform user scenarios into screen flows

After gathering all of the

information about the main usage scenarios and creating the information

architecture, the strategic part of our banking UX design was ready.

These maps are made to establish the right order for the essential user scenarios that have been determined in the earlier phases. It helps to design and adapt the actions that users have to take in order to achieve their goals.

7. Proof of

concept

My Goal was to prepare a

concept of a banking design displaying the implementation of the most and basic

user scenarios. Design screens were prepared and integrated in to a clickable

invision prototype. Also, a motion design video was created.

About Author

%20in%20India.png)